This book is an introduction to ESG, with the ‘S’ as its focal point. Environmental and governance criteria are briefly presented before focusing on the human and social values within ESG. There is an increase interest for these three criteria and this book reiterates the importance of the human factor within the organization.

ESG was first introduced in the United Nations Principles on Investments Report (PRI): the document was published in 2006 and states that companies must incorporate financial indicators to build sustainable investments. Corporations lead the way and include ESG indicators in their annual reports. Most medium and small-size companies have yet to follow.

The ESG analysis tends to focus on governance and environmental concerns. Little attention is given to social responsibility criteria. For this reason, The “S” in ESG: a social impact gives priority to the human aspects of business.

For years, the job market was led by employers; a recent shift is leading towards an employee’s market: Millennials (born 1981-1995) count for 34% of the 2021 workforce, while Generation Z (born 1997-2010) represents 21%. With a combined 54%, these young professionals now demand actions from their employers on issues around ESG values. They are more careful about their consumption and tend to spend locally.

Organizations now need to comply with their employees’ demands.

Why this book?

At the beginning of 2022, a search for publications presenting social values within ESG ended up being disappointing. Little information was available, and rarely discussed, in comparison with the environment or governance criteria. This finding encouraged me to write this book: it is geared at executives and managers willing to measure ESG indicators and looking at ways to address the social part of ESG.

The ‘S’ in ESG: a social impact describes various production sites where employees presented their company from the inside. As a social responsibility auditor, I perceived the struggles of employees. These experiences illustrate their human interactions and their influence on the company and corporate results. Social auditing is a way to assess the strengths and weaknesses of an organization and how the company manages its workforce.

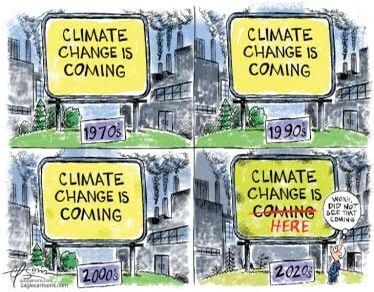

Alan Jope, CEO of Unilever, helped launch the Unilever’s Climate Transition Action Plan. He said that “Runaway climate change, environmental degradation and social inequality are some of the biggest problems that the world faces today”1. The 2020 pandemic has exacerbated the issue of corporate sustainability; public and private institutions are now measuring social successes beyond their sole financial value. Sustainability includes governance responsibility, environmental concerns, and social ethics.

Who is my reader?

Anyone interested in Environmental, Social and Governance values is invited to read The ‘S’ in ESG: a social impact.

The book offers social perspectives within companies, showing how management decisions impact the workforce.

In this book, company managers may find the guidance they need to implement social indicators in their organization. A reader looking for theory based on examples will appreciate this book:

- The first section focuses on a description of ESG values.

- The second section scrutinizes social values within ESG.

- The third section analyzes the employer’s viewpoint.

- The fourth section presents the employees’ perspective and how they create change.

Where do examples come from?

The audited companies are used as examples to illustrate the book because examples speak louder than words. These experiences illustrate the importance of the human factor and how some business leaders react towards their employees. The audits present different contexts, including: a slaughterhouse, a food manufacturing plant, a chemical plant, a glass manufacturing facility, a French haute-couture fashion house, a human resources agency, etc. These companies employed between 20 to 4,500 workers and are a sample of the vast assortment of businesses an auditor may come across.

The privacy of the companies and employees mentioned in this book is protected. Their identities are not relevant because the interest lies in the situations that arose during audits, and in the way the auditor is able to get an “insider’s view” of industries that are otherwise not known to the public.

About ESG

There are three business fronts to consider:

1. Environmental challenges

Environmental challenges are here to stay. Increasing climate instability leads to unprecedent weather catastrophes hitting businesses, individuals and their families, and the communities.

How small adjustments lead to change? How does a company know how to proceed?

Where to start?

Social values are changing. Changes in the market reveal unexpected work situations. The “great resignation”2 in the US has shown a social shift in workforce priorities and demands: 4.5 million people quit their jobs in November 2021 alone.

How are employers dealing with such complex workforce situation?

3. Governance

Governance must comply with guidelines. Growing shareholders’ expectations and stricter regulations are putting pressure on managers. Non-financial performance indicators are becoming an asset for upper management, their workforce, investors, regulators, and society at large.

How to start the ESG process?

One example of social responsibility in ESG

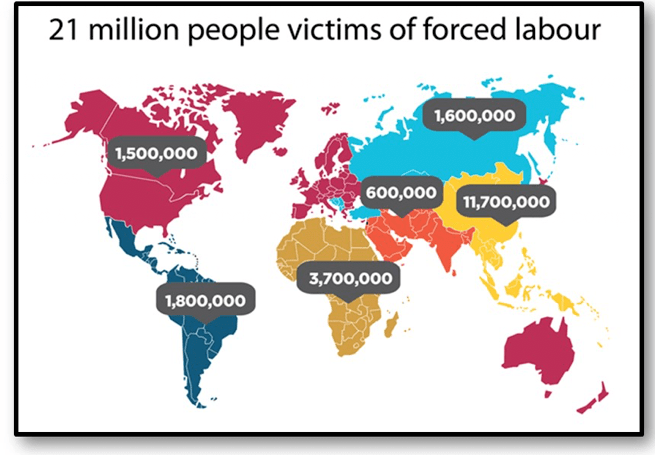

A 2016 ILO publication estimated that over 21 million people suffer from forced labor”3. Consequently, any social strategy must include evidence of ethical values that protect the workforce.

How to assess the legality of employment practices when procedures are close to fraudulent?

A question of transparency

ESG performance implies transparency. Companies’ indicators reveal their willingness to respond to internal and external demands. Those that choose to comply with ESG requirements must demonstrate their ethical work in all three areas.

To show compliance, companies include ESG indicators in annual or sustainability reports.

Conclusion

A good ESG strategy becomes a new way of doing business. The “S” in ESG: a social impact introduces the concepts that form the trilogy, providing an overview with a focus on social responsibility. ESG social awareness is a safe approach to long-term sustainable business practices.

Thank you!

For more information on the upcoming publication, go to www.imago-int.eu

About Oliver

0 Comments

Leave a reply Click here to cancel the reply

You must be logged in to post a comment.